Raisin Market Report – 2025

The Turkish raisin industry is entering its third consecutive year of short crops.

Raisin Market Report – 2025

The Turkish raisin industry is entering its third consecutive year of short crops. In earlier seasons, “downy mildew” disease damaged vineyards and reduced yields for two years. In 2025, severe frost hit the vines, especially in the region stretching from Manisa to Gölmarmara, causing average losses of around 80%. This region is also where organic and IPM production is concentrated, making the impact even more significant.

Official authorities declared the crop at 185,000 mt. Adding an estimated 25,000 mt of carry-over, we foresee total availability at approximately 210,000 mt. The actual outcome will still depend on the fresh versus dried grape balance.

Quality Outlook

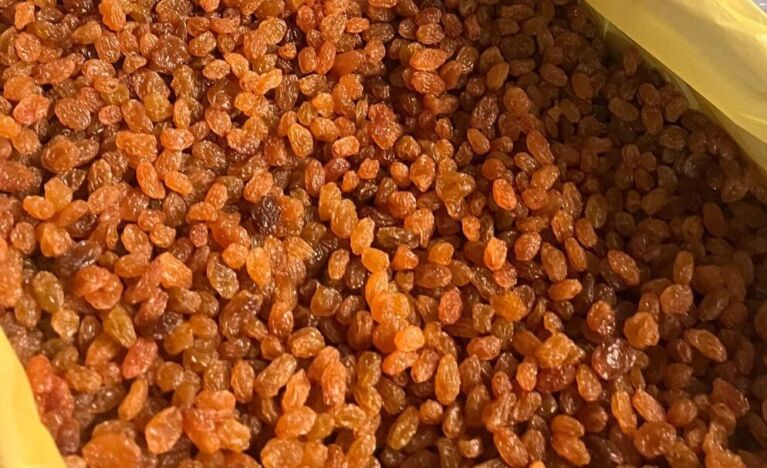

The 2025 crop is showing remarkable quality. Dry and windy conditions during drying have resulted in excellent coloration, and dark grades (No. 7) will be scarce. The proportion of raisins dried without dipping oil (Bandırma) is lower, which will make natural Thompson raisins even more limited. With fewer grapes per vine, berries developed larger and with higher sugar content, making the fruit heavier even in smaller sizes. This season’s raisins are exceptionally uniform - highly consistent in size, color, and quality - and represent a level of excellence rarely seen in recent years.

We are currently right in the middle of harvest, and fruit is flowing rapidly into our warehouses. We are trying to secure as much as possible, because recent seasons have proven that once growers step back after harvest, raw material becomes very difficult to source. New crop shipments have already started.

Exports

These are historically challenging market conditions: in foreign currency terms, raisins are expensive for buyers, while in local terms, growers remain unsatisfied. This mismatch is mainly due to the strong Turkish Lira. Despite inflation running at around 50%, the Lira has lost far less value against foreign currencies. Farmers face rising costs in both local and foreign currency terms, and they expect the same appreciation in their product. The perception of a short crop reinforces this resistance, making growers reluctant to sell.

Last season, Turkey’s exports were limited to 150,000 mt despite high levels, as buyers shifted to alternative origins. Still, even in such a short year, 25,000 mt of carry-over remained. In 2024, China, Iran, the USA, South Africa, and Uzbekistan all had strong crops. For 2025, Iran is expected to be down 30–50%, Uzbekistan is smaller, while the USA and China are reported to have good crops again. Overall, global availability is lower compared to last year.

Conclusion

This season offers fruit of outstanding quality - uniform, sweet, well-colored, and rarely matched in recent years. However, dark grades and natural Thompson raisins will be in very short supply. Alongside tighter global availability and grower resistance in Turkey, this sets the stage for a more volatile season ahead.